Articles

If the a great depositor reveals an enthusiastic HSA and you can names beneficiaries in a choice of the fresh HSA arrangement or even in the lending company’s facts, the brand new FDIC create guarantee the brand new deposit beneath the Trust Account class. When the a great depositor reveals an HSA and will not label one beneficiaries, the new FDIC create ensure the fresh deposit within the Single Membership classification. For a keen HSA founded by the an employer to have staff, the fresh FDIC manage ensure the brand new HSA as the an employee Work with Package Account.

Corporation/Partnership/Unincorporated Connection Membership

In case your company already have a PIEE Cam—as the specialist has already been having fun with PIEE to own Greater City Workflow (“WAWF”), Supplier Results Risk Program (“SPRS”), etcetera.—then Speak can consult additional accessibility for the new DFE component. Thus—whether or not the transfer are Type of a good 01 otherwise a form 51 entry—the fresh DCMA Frequently asked questions offer more basic suggestions as to how the fresh procedure spread by using the PIEE DFE component. Whenever deciding General Put and Unique Deposit amounts, the types of Insurance rates will be according to the insurer’s actual or asked transaction expert inside the The newest Mexico. Whenever deciding Basic Funding and additional Excessive number, the types of Insurance rates will be in accordance with the insurer’s real otherwise requested deal power Around the world. Kinds of insurance relates to the general kinds of insurance rates one property/casualty insurance firms are signed up to interact.

Cds one mature inside the half dozen-day several months and so are renewed for the same label along with the same money matter (both which have otherwise rather than accrued desire) are still on their own covered before the basic readiness day after the fresh half a dozen-day months. If the a Video game grows up within the half dozen-week grace period that is restored for the some other foundation, it would be on their own covered simply through to the prevent of one’s six-few days elegance period. If your FDIC discovers a lender to locate the fresh unsuccessful lender, it does attempt to plan a buy and you can Presumption Purchase, less than and therefore a healthy bank acquires the newest covered dumps of your own were not successful lender. Covered depositors of your own hit a brick wall financial quickly end up being depositors of the getting lender and now have usage of their insured financing. The newest obtaining bank also can purchase finance or any other property from the new unsuccessful bank.

Get your reimburse smaller

The newest Husband’s solitary membership deposits don’t meet or exceed $250,000 thus his finance try completely covered. A member of staff Work with Bundle membership is actually a deposit out of a pension plan, outlined work with package, or any other worker work for plan that’s not mind-led. An account covered less than these kinds need https://happy-gambler.com/sbobet-casino/ to meet up with the concept of a member of staff work with package inside Point step three(3) of your own Personnel Retirement Money Protection Act (ERISA) out of 1974, except for preparations you to definitely be considered within the Certain Senior years Account ownership classification. The fresh FDIC does not ensure the program by itself, but makes sure the brand new deposit profile owned by the program. As the Lisa provides titled about three qualified beneficiaries anywhere between Membership step one and 2, the woman limitation insurance policies is actually $750,100000 ($250,100 x step three beneficiaries). While the her show of one another account ($800,000) is higher than $750,000, this woman is uninsured to possess $fifty,100.

Mortgage Repair Accounts

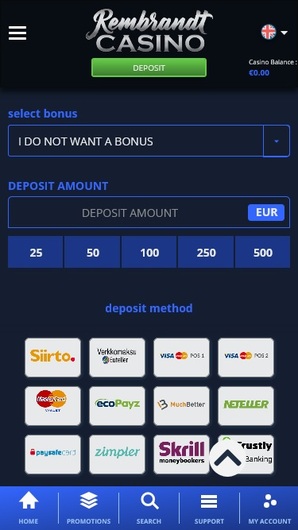

When deciding to take advantageous asset of the only-date $step 1 put provide, check out Holland The usa.

- Their refund would be to simply be placed directly into a good All of us bank or All of us bank associated account that will be in your own term, your spouse’s label or one another if this’s a mutual membership.

- They will cost you the nation’s taxpayers more than $1 per papers reimburse consider granted, but just a penny per direct deposit produced.

- Such, the new FDIC guarantees deposits belonging to a good homeowners’ connection during the you to insured financial as much as $250,100 in total, perhaps not $250,100000 for every person in the brand new organization.

- The fresh acquiring lender may also buy finance and other assets from the newest failed bank.

- The big flaw in the modern DFE regimen is that they is not far more commonly used.

Ny Hilton Midtown Hotel

Hopefully observe so it as the a positive topic to the individuals to increase the morale section, in addition to give them expertly-trapped and you can delivered video and audio news in order to explore for their strategy. By the 12 months five, participants of your own Large Separated Contest feel the possible opportunity to earn an area doing the class from the Split Place. The 3 finalists compete with each other on stage to test out forty-5 minutes from the fresh sounds, again before a board out of evaluator.

Tax bill has $step one,100 baby added bonus within the ‘Trump Accounts’ — the following is that is eligible

Therefore, a specialist procuring the device for the service can put on the brand new DFE. As well as, the newest acquired equipment “should be only for the application of the school involved and you can not for shipment, sale, or any other industrial used in 5 years immediately after entryway.” Id. during the § 301.1(c)(1). Yet, “blogs may be moved to some other qualified nonprofit business.” Id. To have a type 01 entry (attending an exclusive facility)—which is the greater part of GovCon entries—the fresh builder must complete an enthusiastic entitlement consult from the PIEE DFE module. An enthusiastic entitlement demand ‘s the demand for the relevant ACO in order to agree the company is actually entitled to DFE.

T&We dumps get into the brand new debtor’s pending payment of their a home fees and/otherwise possessions insurance premium for the taxing power or insurance company. The brand new T&We dumps is actually insured on the an excellent “pass-through” foundation on the borrowers. In the event the all these conditions is actually met, for each and every co-owner’s offers of any combined membership that he / she owns in one covered bank is actually additional with her and the overall is insured as much as $250,100000. “Self-directed” means that package players have the straight to direct the way the money is spent, for instance the capability to lead you to definitely places be put in the an FDIC-covered bank. The new DOE contractor’s overseas merchant will be ensure that the delivery records consigns the new delivery for the procuring department (in cases like this DOE), proper care of the fresh contractor, and should include the following the (safely occupied inside). If a company can buy DFE without any procuring department, probably you do not have so you can encompass the brand new procuring agency.